How To Trade Order Blocks In Forex Trading Explained

The term 'orderblocks' refers to certain candlestick formations or bars that suggest what is known as 'smart money buying and selling' when viewed in an institutional context (i.e the foreign exchange transactions between central banks, commercial hedgers and institutional traders) displayed on price charts.

Order Block Trading Strategy and PDF Guide Free Download

What Are Order Blocks and How Do They Form? 3 Identifying Bullish and Bearish Order Blocks Bullish Order Blocks Bearish Order Blocks 4 How to Trade Order Blocks: A Step-by-Step Strategy Identifying Order Blocks Waiting for the Return Choosing Your Target 5 Using an Indicator to Spot High-Probability Order Blocks

Cách sử dụng Order Block (Khối lệnh) để giao dịch cùng hướng với Big Boy

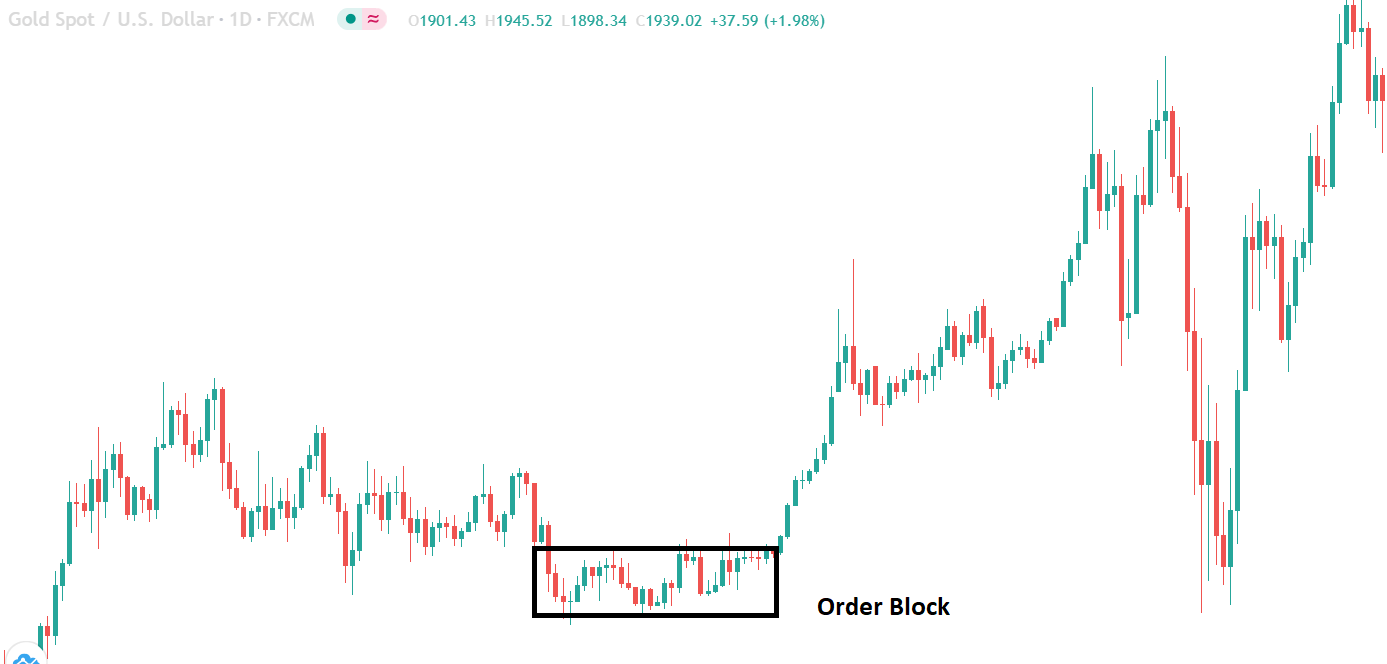

Order blocks are high probability supply and demand zones created when the banks split a single large trading position into many smaller positions. They provide low risk/high reward reversal entries and make a great side setup alongside a main strategy. Sound interesting? Without further ado, let's crack on with the guide…

Order Block Trading Strategy 3 Strategies Explained ForexBee

* An order block is a defined area where buyers or sellers of smart money entered market & moved price away from its price level to a new area of interest. Why Order Blocks: * The market is engineered by smart money by means of creating levels within the market place for them to use at a later date and time. How To Identify Order Blocks:

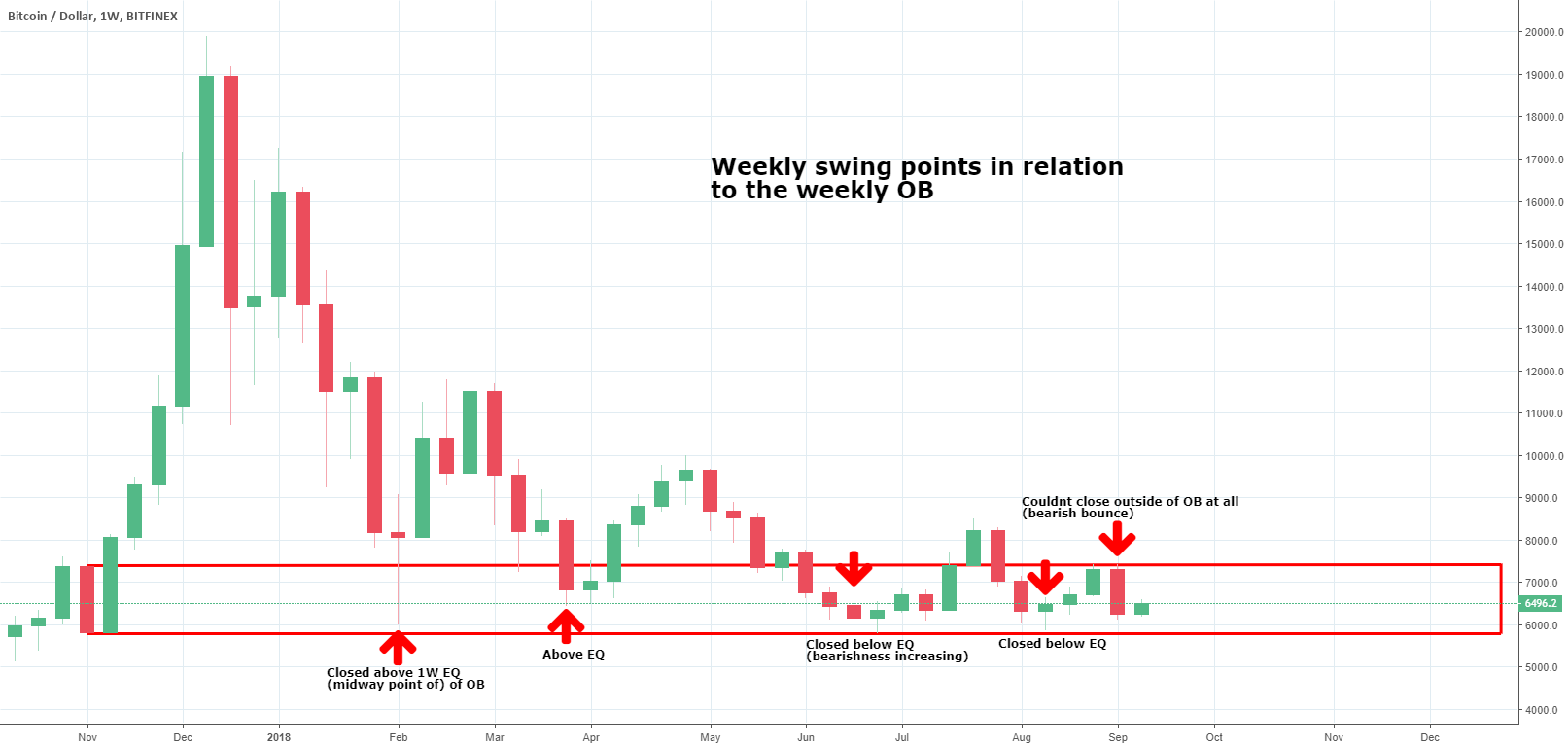

Order Block Breakdown for BITFINEXBTCUSD by BoomerangCap — TradingView

14 0 Order Blocks Explained Now we'll look at one of the important concepts we utilize to find our precise entry points: order blocks. So, what exactly is an order block? An orderblock is a visible spot on the chart where a large order is being placed on the market. You'll notice the order being placed, followed

How to find Order Blocks in Cryptocurrency? ForexBee

1. Pin bar and order block Trading Strategy The pin bar trading strategy combines well with the order block. The idea is to locate a bullish or bearish order block, and whenever the price returns to these levels, creating a pin bar, we can enter our trades.

Order Block Definition Forexpedia™ by

An Order Block trading strategy is a powerful tool used in the world of financial markets to identify key levels where significant buying or selling activity has taken place. It revolves around the concept of grouping together market orders that have been executed at a specific price level, forming what is known as an order block..

Order blocks forex theforexscalpers

Order blocks function as areas of accumulation or distribution, where institutional traders buy or sell large positions. When the market reaches these levels, the imbalance between supply and demand creates a shift in price momentum.

Order Block in Forex Trading All You Need To Know Forex Traders Guide

A block trade is a large, privately negotiated securities transaction. Block trades are generally broken up into smaller orders and executed through different brokers to mask the true size..

Order Block in Forex Trading All You Need To Know Forex Traders Guide

Here's a step-by-step guide to trading order blocks: 1. Identify order blocks

How To Find And Use ICT Order Blocks In Your Trading PriceActionNinja

So what's an Order Block? An Order Block is a handy tool that helps us see where the big guys are likely to put their money. It's like a secret sign where big businesses gather their orders before diving into the market around areas known as Order Blocks.

ICT trade plan using breaker and order block for FXEURUSD by

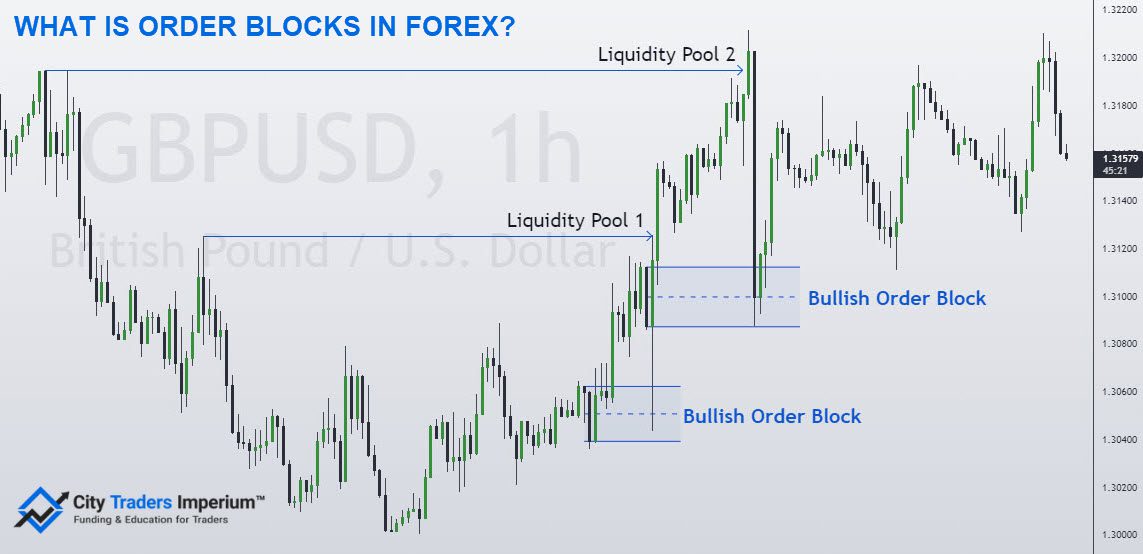

Order blocks is a unique trading technique or theory at which traders aim to identify price levels where large institutions and investors enter the market. In this article, we will explain what order blocks are in the forex market, how to identify these orders, and how to add the order block trading strategy to your trading arsenal.

Order Block in Forex Trading All You Need To Know Forex Traders Guide

At its core, an order block is a substantial accumulation of buy or sell orders set at a particular price range by large financial institutions and traders. These entities, often called " smart money ," have the market clout to influence currency prices significantly.

What Are Order Blocks In Forex and How Can You Profit From

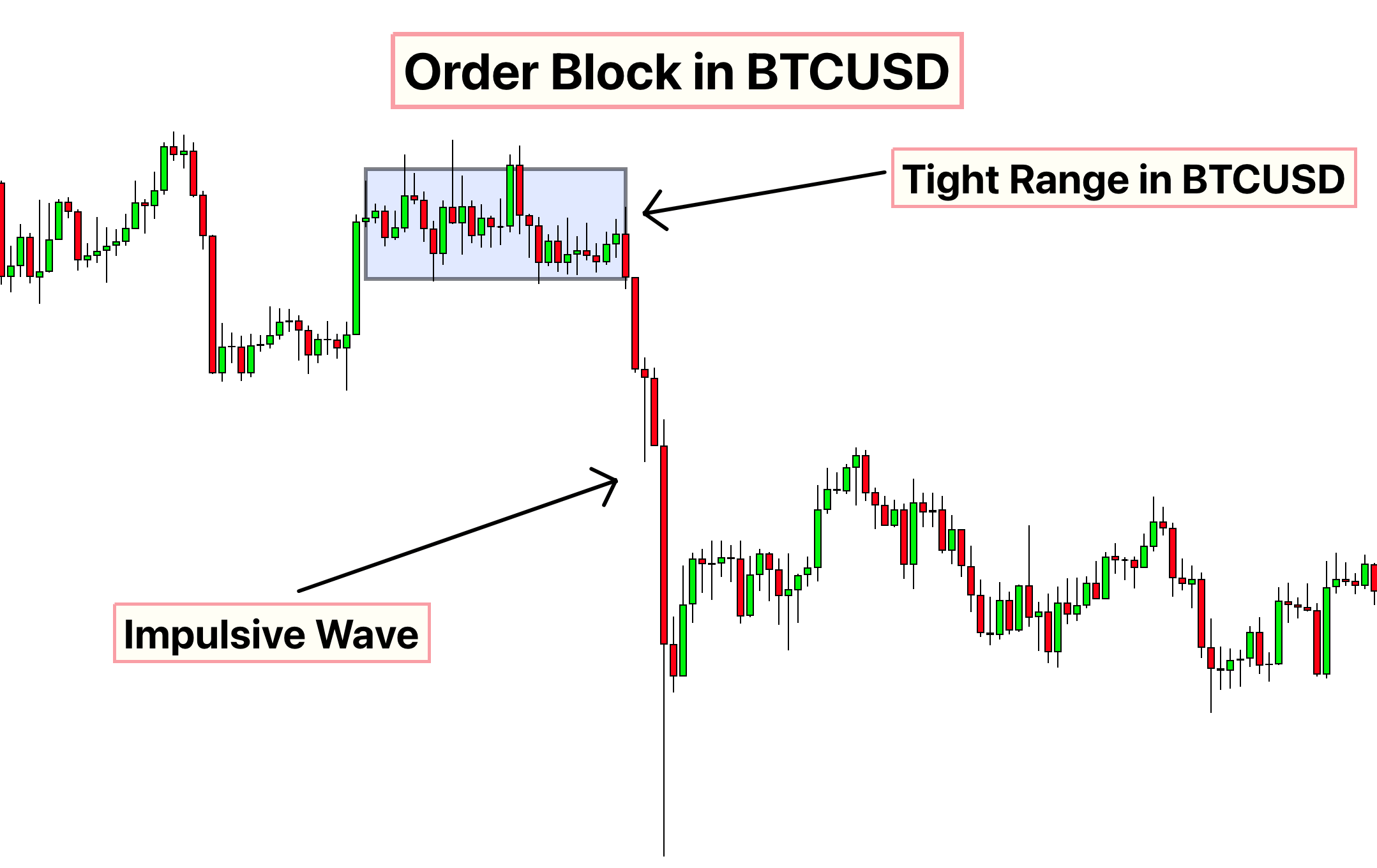

OB = ORDER BLOCK The LAST BULLISH or BEARISH cand before an IMPULSE up or down, represent an OB or Order Block.-Why do we call them order blocks and why are they important? Order Blocks are one type of supply and demand on the market, you can expect them to act as a support or resistance depending on the impulse after them. an OB is where larger players (whales, institutions, banks) have.

Forex Order Block Strategy for Beginners Lux Trading Firm

Order Block Trading Strategy is a method that involves identifying and trading off significant price levels on a price chart. Traders using this method look for areas where large buying or selling activity has occurred in the past, potentially acting as areas of support or resistance in the future.

Order Block In Forex, 4 Insane Rules To Add To Your Strategy

Order blocks occur as a result of market response to large orders placed by institutional traders, creating noticeable disruption in market behavior that results in visible areas on price charts that become known as order blocks - an essential resource for traders when conducting analysis.